Contact Us

Write to us to start cooperation or ask the

questions. We respond within 1 hour

Write to us to start cooperation or ask the

questions. We respond within 1 hour

Send us your contacts and we will

contact you within 1 hour

Send us your contacts and we will contact you within 1 hour

Last updated: 02.07.2021

The Hellenium Project and its subsidiaries (“Hellenium”, “we” or “us”) welcome you to our website, mobile applications and other services provided via electronic means (together referred to as “Electronic Services”) and appreciate your interest in our products and services. Hellenium attaches importance to appropriate data protection. This page explains how we treat your personal data in connection with your use of our Electronic Services (“Privacy Policy”). By continuing to use the Hellenium, you confirm that you are 18 years of age or older. Please note that we may amend this Privacy Policy from time to time. The applicable version is always the current one, as referenced above (last updated).

Protecting your privacy and treating the personal data of all users of our Electronic Services in accordance with the law is important to us. We understand that by using our Electronic Services you may be entrusting us with personal information (“data”)

and assure you that we take our duty to protect and safeguard this data very seriously. This Privacy Policy therefore explains the kind of data we process when using our Electronic Services, the purpose

for which we process it, how we process it, whom we may disclose it to and the security measures we have put in place to protect it.

This Privacy Policy

applies to all data we obtain through your use of our Electronic Services. It does not apply to data we obtain through other channels nor to Electronic Services of third parties (“third-party Electronic

Services”), even if you access them via a link in our Electronic Services or even if they are necessary for the operation of our Electronic Services. We have no influence on the content or privacy policy

of third-party Electronic Services and therefore cannot assume any responsibility for them.

When you use our Electronic Services, details of your usage may be automatically registered by our backend systems (such as your IP address, browser, http-header user agent, device-specific information the content you accessed, including time and date of access, usage and user interaction, and the redirecting website from which you came to our Electronic Services). We also process personal data such as your name, address, e-mail address, phone number, date of birth, gender and other data transmitted to us if you register for the usage of our Electronic Services or if you complete a registration form or comment field for a newsletter, product demos, etc..

We process the data based on the following legal grounds:

-For the performance of a contract to which you are a party or in order to take steps at your request prior to entering into a contract;

-For compliance with a legal obligation to which we are subject;

-For the purposes of our legitimate interests.

We process the data for the following purposes:

-To comply with bank’s

own internal guidelines;

-To check the identity and suitability of clients for certain products and services;

-To establish a basis for future information on the products and services offered by

Hellenium and to improve their quality;

-To facilitate technical administration, research and further development in connection with the Hellenium;

-To ensure the security and operation of our IT

environment;

-To use it for marketing and advertising measures (e.g. newsletters via e-mail, online advertising);

-To analyse and monitor the usage, user behaviour and navigation while using the Electronic Services;

-To facilitate client administration.

We process all your personal data in accordance

with the applicable laws on data protection and for as long as required.

Hellenium only discloses Electronic Services usage data to third parties as permitted by law, if we are legally obliged to do so or if such disclosure becomes necessary to enforce our rights, in particular to enforce claims arising from a contractual

relationship. Within this scope as well as for the purpose of optimising our products and services, we may transmit data within the Hellenium Group between Group companies in Switzerland or abroad. Furthermore,

we may disclose data to external service providers if this is necessary for the provision of products and services. Such service providers may not use the data for any other purpose than to process the order

in question. All of the above persons and entities that may receive data must observe the applicable national and international data protection laws as well as the data protection standards of Hellenium.

Where so prescribed by applicable legislation, Hellenium may on request or under an ongoing duty to provide information disclose data to supervisory authorities, judicial authorities or other persons

of authority.

Hellenium will make every effort to take appropriate technical and organisational security measures to ensure that your personal data processed within the IT environment controlled by Hellenium is protected against unauthorised access, misuse, loss and/or

destruction, taking account of the applicable legal and regulatory requirements.

Hellenium takes both physical and electronic process-specific security

measures, including firewalls, personal passwords, and encryption and authentication technologies. Our employees and the service providers commissioned by us are bound by professional secrecy and must comply

with all data protection provisions.

Additionally, access to personal data is restricted to only those employees, contractors and third parties who require this access in order to assure the purpose

of data processing and the provision of products and services (need to know principle).

Hellenium would like to draw your attention to the fact that if you use our Electronic Services via an open network, this may allow third parties (e.g. app stores, network providers or the manufacturer of your device), wherever they are located, to access

and process your data. Open networks are beyond Hellenium’s control and can therefore not be regarded as a secure environment. Any transmission of data via such open network cannot be guaranteed to be secure

or error-free as data may be intercepted, amended, corrupted, lost, destroyed, arrive late or incomplete, contain viruses or may be monitored. In particular, data sent via an open network may leave the country

– even where both sender and recipient are in the same country – and may be transmitted to and potentially processed in third-party countries, where data protection requirements may be lower than in your

country of residence.

Where data is transmitted via an open network, we cannot be held responsible for the protection of this data and we accept no responsibility

or liability for the security of your data during transmission. We, therefore, recommend avoiding the transmission of any confidential information via open networks.

The Hellenium use cookies for statistical purposes as a tool for our web developers and to improve the user experience. Cookies are small files which are stored on your electronic device to keep track of your visit to the Electronic Services and your

preferences; as you move between pages, and sometimes to save settings between visits. Cookies help the builders of Electronic Services gather statistics about how often people visit certain areas of the

site, and help in tailoring Electronic Services to be more useful and user-friendly.

Please note that most web browsers accept cookies automatically. You

can configure your browser to not save any or only certain cookies on your electronic device or to always display a warning before receiving a new cookie. Deactivating cookies can, however, prevent you from

using certain functions on our Electronic Services.

Please click here to let us know how we can use cookies. You can withdraw your consent at any time. These settings do not apply to Hellenium mobile

applications.

Remark: For some Electronic Services, cookies are only persistent during user session and will be deleted after the session is terminated.

We use various analysis tools from third parties such as Google Analytics for the purpose of reporting for Electronic Services. This involves the creation of pseudo-anonymised data and use of cookies to help analyse how users use our Electronic Services.

The information about your use generated by these cookies, such as the

-host name of the accessing electronic device (masked IP address)

-type/version

of browser used

-operating system

-referrer URL (website from which visitors are redirected to the Hellenium by clicking a link)

-date and time of server request

-device-specific information

may be transmitted to third party servers located in countries outside of the European Union and is used for analysis purposes.

Please click here to let us know how we can use cookies. You can

withdraw your consent at any time. These settings do not apply to Hellenium mobile applications.

Please refer to the previous section, “Cookies”, for information on deleting cookies.

The Hellenium may contain links to third-party Electronic Services that are not operated or monitored by us. Please be aware that such third-party Electronic Services are not bound by this Privacy Policy and that we are not responsible for their content or their principles regarding the handling of personal data. We therefore recommend consulting and checking the individual privacy policies or terms of use of third-party Electronic Services.

According to applicable data protection laws and regulations, you may have the following rights:

-requesting information on personal data that we hold about you,

-demanding that the information

be rectified should it be incorrect,

-asking that your data be deleted if the Bank is not permitted or is not legally obliged to retain the data,

-demanding that the processing of your data be restricted,

-objecting to the processing by us,

-transferred in a generally useable, machine-readable, and standardised format.

You also have a right of appeal (as far as this affects you) to the respective

Data Protection Supervisory Authority

If you have questions about the processing of your personal data, please feel free to contact us by using the following contact details:

Hellenium & Co. Ltd.

Global Data Protection Officer P.O.

Box 8010 Zurich, Switzerland

dataprivacy@juliusbaer.com

“What do you mean transaction-free ?” ... “Transaction and trade are practically synonyms ... the one cannot exist without the other can it ?... and what is wrong with transactions any way?”

All fair comments that I've heard endless times over the last 35 months.

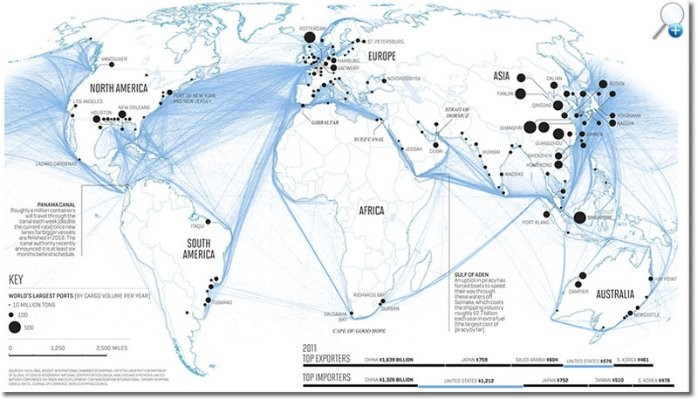

I will start from the last point. There are 43 trillion reasons why we need to get rid of transactions. That much is the cost in USD PER YEAR that businesses around the globe incur - if one counts both the external and internal cost - in order to transact through the existing legacy systems.

A single B2B cross border transaction requires today at best 13 actors which share between them 108 interactions and takes on average 43 hours to be completed.

Who do you think is paying the 11 “mediators” of every single transaction, your customer? Think again. YOU ARE THE CUSTOMER. Not just of one business but of all business in the supply chain before you !

And you are not paying it just once either. Transaction cost is basically overhead that every business will add to its basic cost before it calculates its margin ! If there are 4 businesses before you in your supply chain and they are working with a 20% margin than you paid 1.2^4 = 2.07 times more and if there are six then 1.2^6= 2.98 than you actually ought to !

If that was not enough, businesses are rarely paid in less than 45 days from their customers. These delays result 9/10 times in problematic cash-flows and additional overhead cost due to borrowing & trade insurance. Once more it is you who is paying the cost which based on same as above formula is most definitely higher than it should be.

Finally, In addition to support all these interactions businesses employ whole armies of accountants, financiers, administrators...lawyers and debt collectors and in order to reduce their operational cost additional armies of consultants. And who is paying the price for this overhead cost? Well, you guessed it. YOUR BUSINESS DOES.

It is no surprise that global profit margins have shrunk to just 11%.

Now lets take transactions out of the equation. Let's assume for a moment that there is a better way to trade - one without transactions. Do any of the above costs will still apply? NO.

Would it not be great consequently if we could get rid of transactions altogether? YES

Well, there are good news for all of us. Now it is possible.

And this brings us to the second point: if trade and transaction are indeed synonyms and if the one can exist without the other and the answer is emphatically NOT.

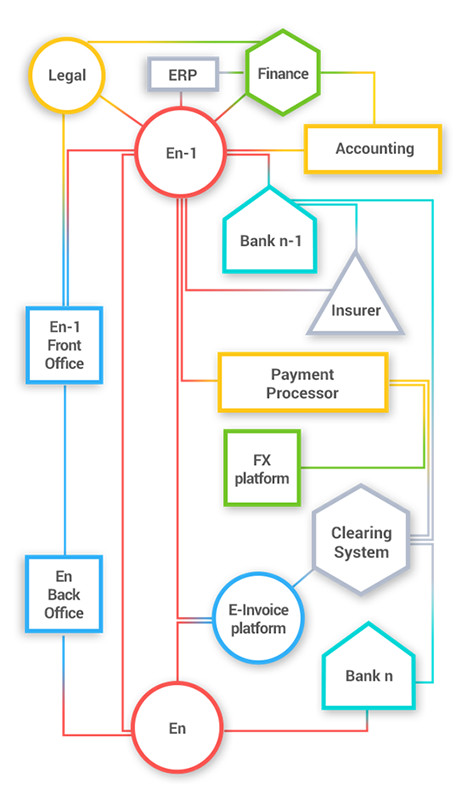

The invention of Two Dimensional Virtual Vertical Integration - or 2DVVI for short – a new techno-methodology that has not reached yet mainstream literature hence you are probably unaware of - makes the impossible possible.

Its principle is dead simple as all great ideas. If the businesses belonging to any supply chain were to merge into one, then of course all transaction between them, trade credit risk, late payments etc. will cease to exist. Expand the principle universally and there would be no need for Banks, SWIFT, Insurers, Payment Processors...etc. Terms late payments, credit lines, factoring, trade credit insurance, leasing etc. will be abandoned from our daily vocabulary.

With merging all businesses across all supply chains on the globe an improbability 2DVVI does the best next thing.

It allows the virtual integration of these businesses (through the use of APIs) transforming this way every supply chain into an ecosystem that now trades as one entity !

Distribution of cost, risk and receivables within these ecosystems are now assigned to intelligent algorithms which are managed by Learning Systems (AI modules). The whole process happens within Blockchain ledgers, is fully automated and carries no counterparty risk. No human hand or mediator (except the owners of the platform where 2DVVI is running) gets involved.

2DVVI allows for the gradual integration of businesses into these ecosystems. From the moment two businesses decide to utilise its facilities an ecosystem seed is created and economies of scale start to appear.

With every new member joining the ecosystem economies of scale increase exponentially for all.

But 2DVVI does not stop there. Every new ecosystem that is created until it expands all the way upstream to its suppliers and downstream to its customers will still need to trade. So on top of the FINTECH modules designed to address the internal value and risk distribution needs of the ecosystem there is the need for these ecosystems to keep on trading. New innovative and low cost forms of value exchanges needed to be developed for that reason. Liquid Payments, new forms of Cashless & Cardless Payments, Mobile Payment systems, new forms of Trade-credit-insurance, of currency contracts (futures), new forms of bi-Directional Cards, FX trade etc. had to be developed and so its designers did.

The end result has profound financial, institutional and social impact.

Within these ecosystems the economies of scale reach extraordinary heights with Cash-flow increases exceeding 350%, Trade Risk reduction reaching 93%, FX cost reduction reaching 75% and Operational cost reduction reaching 98%. That is Lean Engineering at its best and with it the dream of an overhead-free production process approaching fulfilment.

Externally the trading cost of these ecosystems is reduced following similar trends with FX costs reduced by up to 33%, Trade credit risk by 50%, Trade credit insurance by a factor of 23! and FX Futures by a factor of 18!

However, the most important now is that all these external costs ARE DIVIDED AND SHARED by all participating in the ecosystem businesses. For example if a 5 businesses deep supply chain becomes an ecosystem which is trading downstream with consumers, card payment processing cost that was on average ~ 2.2% will now be 0.44% for each (assuming all of them contributing to the same extend in the products value creation). The same stands true for all other cost parameters with trade-credit-insurance cost able to drop to as low as 1/1000 of today's costs and currency contracts cost to below 1/500 !

The institutional shift will be even more dramatic. The rules of Taxation, Banking, International Trade and Trade Credit insurance will need to be re-written. Values would be able to be expressed to anything from fiat currencies to digital ones and from commodities to derivatives. Savings would be able to be stored in all kind of things from information to manufacturing stocks and the notion of the Pension will be altered for ever. Business Ecosystems and Individuals will be able to become Market Makers trading anything and everything. Taxes and employment contributions can now be collected automatically and in real time. Businesses will be able to exist (virtually) in any number of countries they choose to, irrespectively of Trade Deals without the need for subsidiaries rendering events like Brexit irrelevant and pay taxes wherever they fill it is socially beneficial. The number of Banks and their role will diminish. States and Ecosystems will be able to create their own credit schemes. New forms of business partnerships, employment, leasing and PPIs will take shape. The boundaries between Businesses the State and the Citizens will be altered for ever.

Finally, the social will be positively impacted as well. Product prices will be reduced to below 50% of what is now, lifting 1.5 billion people above the poverty level. With the notion of cheap labour out of the equation thanks to the birth of the enterprise in the cloud all unnecessary transportation will gradually be reduced and with it the levels of pollution that impact climate change. Unemployment will become a thing of the past as the boundaries between the business ownership and employment will disappear. Salaries will keep on increasing as businesses will gradually increase their profitability and liquidity. Human effort will be migrated from trivial overhead duties into productive ones helping us to climb one step higher in Maslow's Pyramid of self-actualisation...